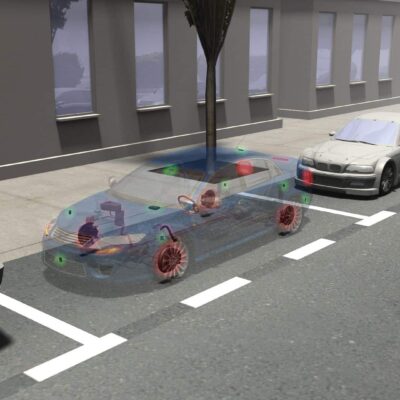

2022 was a transformative year for many American markets, especially those being shifted by rapid technological advancement, increased government oversight, and evolving consumer values. And when it comes to the automotive industry, the EV landscape is going through a complete metamorphosis, especially as we move further toward Biden’s 2030 electrification goals. More and more companies are entering into the electric vehicles race, opening the door for patent battles, theft of trade secrets disputes, and conflicts over systems security, especially as these vehicles’ wireless capabilities grow.

Let’s take a quick look at 2022’s EV litigation landscape to learn more about what types of cases have been hitting the courts and who has been involved in the disputes.

| Industry | District Court Cases | 5 most common case types (with # of cases) | Top 5 Plaintiffs* | Top 5 Defendants* |

|---|---|---|---|---|

| Electric Vehicles | 1187 |

|

|

|

An Industry Insider’s Perspective

To make sense of this data, we asked WIT IP Panel member and automotive industry expert, Lawrence Achram, to opine on the state of the industry as we enter 2023. Here’s what he had to say:

WIT: After looking at this data, do you feel that 2023 will see a similar landscape in terms of case type?

Lawrence Achram: I expected to see IP issues showing up in the top five (it came in at number 6 with 60 cases) given the explosion of patent filings in the EV space and the larger manifestation of the forecasted convergence of telecom into vehicles. EVs and autonomy are a natural fit given the necessary connectivity in the vehicles. Even beyond EVs, vehicles, both on and off-road, are going to be one of the most extensive examples of the “internet of things” out of necessity. This means that the large portfolio of telecom and connectivity patents that I tried to warn my contemporaries about a few years back is going to come to bear. So, though it wasn’t in the top five this year, I expect to see it there for 2023.

WIT: How do you feel increased vehicle connectivity will affect the industry?

Lawrence Achram: IOT automotive experiments have been interesting so far, but there is a regulatory backdrop that must stabilize. The dilemma for automakers remains: they need connectivity to be able to manage vehicle software today, but they would like to monetize the cost of the cell system to recover costs (they have been installing cell service in new vehicles and it only makes sense that newer vehicles would move to 5G.)

Unfortunately, this requires the customer to pay for an additional cell service contract- something they have been reluctant to do. Thus far, the automakers’ service offerings do not seem to generate enough additional value over the customers’ individual smartphones to entice subscriptions. Pricing for a limited feature set is surprisingly high.

Possible solutions could include baking the price of the service into the vehicle price. The carriers could also reinvent their engagement with the customers to incorporate an additional vehicle phone with shared connected services for the family. But the problem is that the automaker is then acting as a reseller, and I have not seen discussions about consolidating services.

Even so, there are potential points of conflict that will need to be watched.

Data and vehicle network security are still concerns. For example, most traditional automakers have been reluctant to perform mission-critical software updates partially for fear of data corruption, but they are more worried about the difficulty of hardening the on-board network to protect it from hackers. To date, most mission-critical updates were being done by hardwire. 5G reliability, speed, and reduced latency improve the success of OTA, but security issues remain.

It will be interesting to see how many IOT features will be offered voluntarily by the automakers and if customers will be willing to pay for them. It is likely that many will become regulatory requirements. The robustness of these features will be something to watch for potential conflict.

WIT: What do you expect to see more of in 2023?

Lawrence Achram: Recently, I noticed that NPE activity has been picking up. I have long advocated for a more proactive strategy among automakers and their suppliers to try to make deals with bulk licensing rather than be reactive when suits are brought.

If I were to make a suggestion to lawyers, it would be to consider prompting their clients to make deals to head off conflicts, recommend cooperative development to capture rogue patents to control the future risk of litigation, and turn the NPE relationship into one of collaboration.

WIT: What issues do you feel with continue to affect the industry as we head into 2023?

Lawrence Achram: One topic in particular that has been top of mind is that of product quality and performance. For example, the recent holiday cold snap that hit a large part of the United States exposed potential weaknesses in EV charging. The frigid temperatures showed that some of America’s electrification stations could not withstand the subzero temps and if this issue isn’t mediated on a nationwide scale, the country’s electrification goals could be hindered.

And worse, several major auto OEMs have had severe quality issues with no solution. Sending a “do not drive” notice to customers without a solution opens the door to potential class action litigation. A vehicle that does not perform to expectations or is disabled could be the catalyst.

The Essential Role of Experts

Turning our attention to impending conflicts, let’s look at the vital role that experts play in preparing for complex litigation involving automotive tech.

When it comes to intellectual property, battles over patents for EV components including charging station technology, battery technology, wireless technology, and more will likely ramp up as automakers attempt to prepare for heightened connectivity and increased EV adoption. With this many players in the space trying to create proprietary systems to achieve the same goal, protecting innovation is essential. Here, experts can step in to address patent pools, damages analyses, EV software, and more in order to help form a strong IP litigation strategy.

Mergers, acquisitions, and impending partnerships will also be an area to watch as companies band together to improve manufacturing operations and take a larger stake in the market. M&As in this sector hit a historic high in 2021, but that also means the risk of litigation regarding these mergers are more likely to grow. Collaborating with an expert can help those involved in M&A transactions understand the contracts, finances, and due diligence associated with acquisitions.

Lastly, conflicts surrounding supply chain issues are likely to increase, especially as automakers attempt to reconcile the quality issues Mr. Achram mentioned above. As the adoption of electric vehicles becomes more widespread, it is now more important than ever to ensure that the charging infrastructure is stable and vehicle components are functional. If these issues continue, class actions will likely begin to pop up, and having an expert on your team that understands the manufacturing, sourcing, and design of these systems can put you ahead of the curve in a complex conflict.

Want to learn more about what’s to come in the automotive industry and electric vehicles space? Reach out to WIT to schedule a partner briefing or to connect with the best experts who can advise you on your EV strategy in 2023. Our electric vehicles expert team was created to address what we expect to be the key areas of litigation in the move to electric and autonomous vehicles.