In early March, we attended Payments Summit 2022 hosted by the Secure Tech Alliance. With a range of presentations by Visa, Mastercard, Amex, and Discover alongside fast-growing fintech start-ups covering the trajectory of financial technology, the Payments Summit provided a sneak peek into some of the emerging innovations in the fintech industry.

Contactless Payments and Identification – Tap to Pay via a chip-enabled card or mobile device is emerging as the de facto method in the post-COVID brick and mortar retail space. Chip readers like the Square devices that were once the ‘creme de la creme’ of financial technology are now pivoting to support services like Apple Pay and other contactless devices. With Apple’s Wallet pushing harder into the Tap to Pay market, there will be more reason for the market to follow the tech giant’s lead (as it tends to do).

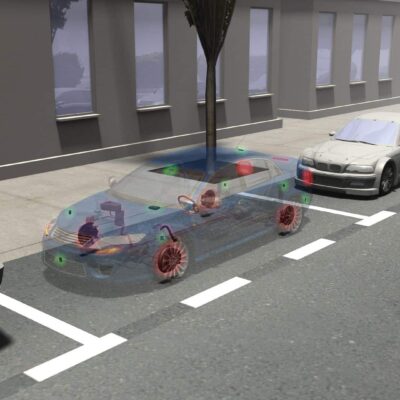

The technology behind Tap to Pay is based on a spectrum of short-range network technologies ranging from the 802.15 WPAN (Wireless Personal Area Network) standard, including Bluetooth (~100-meter range) and Bluetooth Low Energy (BLE – ~50-meter range) down to Near Field Communications (NFC – 10-centimeter range). While much of the litigation in wireless technology involves longer-range communication like 4G, 5G, and others, we expect an increase of litigation related to short-range wireless technologies as contactless and pay-with-phone methods grow.

Similarly, contactless identification is expected to emerge in 2022 as the new normal for presenting information for identity verification, with the most common application coming in the form of mobile drivers’ licenses (mDLs). While several states have started pilot programs, in September 2021, Apple announced that Arizona, Connecticut, Georgia, Iowa, Kentucky, Maryland, Oklahoma, and Utah will be the first states to adopt mDLs as part of Apple Wallet. Like Tap to Pay, mDL involves a spectrum of shorter-range technologies to enable its use.

Authentication Technology – Security is still top of mind for the payments industry. Fraud involves a significant cost to merchants, payment companies, and consumers and security protocols have not kept up with the need or the technology. In the next 12 months, the industry will move toward “frictionless” and/or “continuous” authentication whereby the user is seamlessly or constantly being authenticated by a series of layered technologies, including biometrics.

Traditionally, consumers have been quite wary of biometrics, which include everything from facial recognition and fingerprint scanning to retina scans and voice identification. But the latest iterations of smartphones have made fingerprint scanning and facial recognition part of basic device usage. While biometrics still has some hurdles including its identification challenges with people of color, it will clearly become part of a future security protocol. Success makes the underlying IP more valuable and consequently, increases the chances for litigation.

The acceleration of trends for contactless payments and authentication will make the implementation of these technologies the target of litigation. If your company needs help preparing for these challenges, reach out to WIT for the best experts who can advise you on your strategy. Our expert teams were created to address what we expect to be the key areas of IP litigation in emerging technologies.