To stay ahead of litigation trends in fast-evolving industries, WIT analyzes its core practice areas to spot patterns in past disputes and anticipate where the next wave of challenges may emerge. Our latest deep dive focuses on biologics under the Biologics Price Competition and Innovation Act (BPCIA). By examining litigation records over the past decade, we set out to identify which products, active ingredients, therapeutic indications, and patents have been most frequently asserted—and to pinpoint areas ripe for future contention. Let’s dive into the data.

BPCIA Breakdown: Cases Over Time

The Biologics Price Competition and Innovation Act (BPCIA) was enacted on March 23, 2010, as part of the Affordable Care Act, creating the first abbreviated pathway for FDA approval of biosimilar and interchangeable biologic products. It balances faster market entry for biosimilars with patent-protection periods for original innovators, shaping the modern landscape of biologics litigation.

Since the BPCIA’s implementation 15 years ago, proceedings under the Act have steadily ramped up; annual filings rose from a single case in 2014 to peaks of nine in 2017 and ten in 2018. In total, 54 proceedings have been initiated—47 (~87%) have closed, and 7 (~13%) remain open.

Now that we are well acquainted with the Act and the YoY case load in this sector, let’s break this data down with some common questions from those litigating in the space.

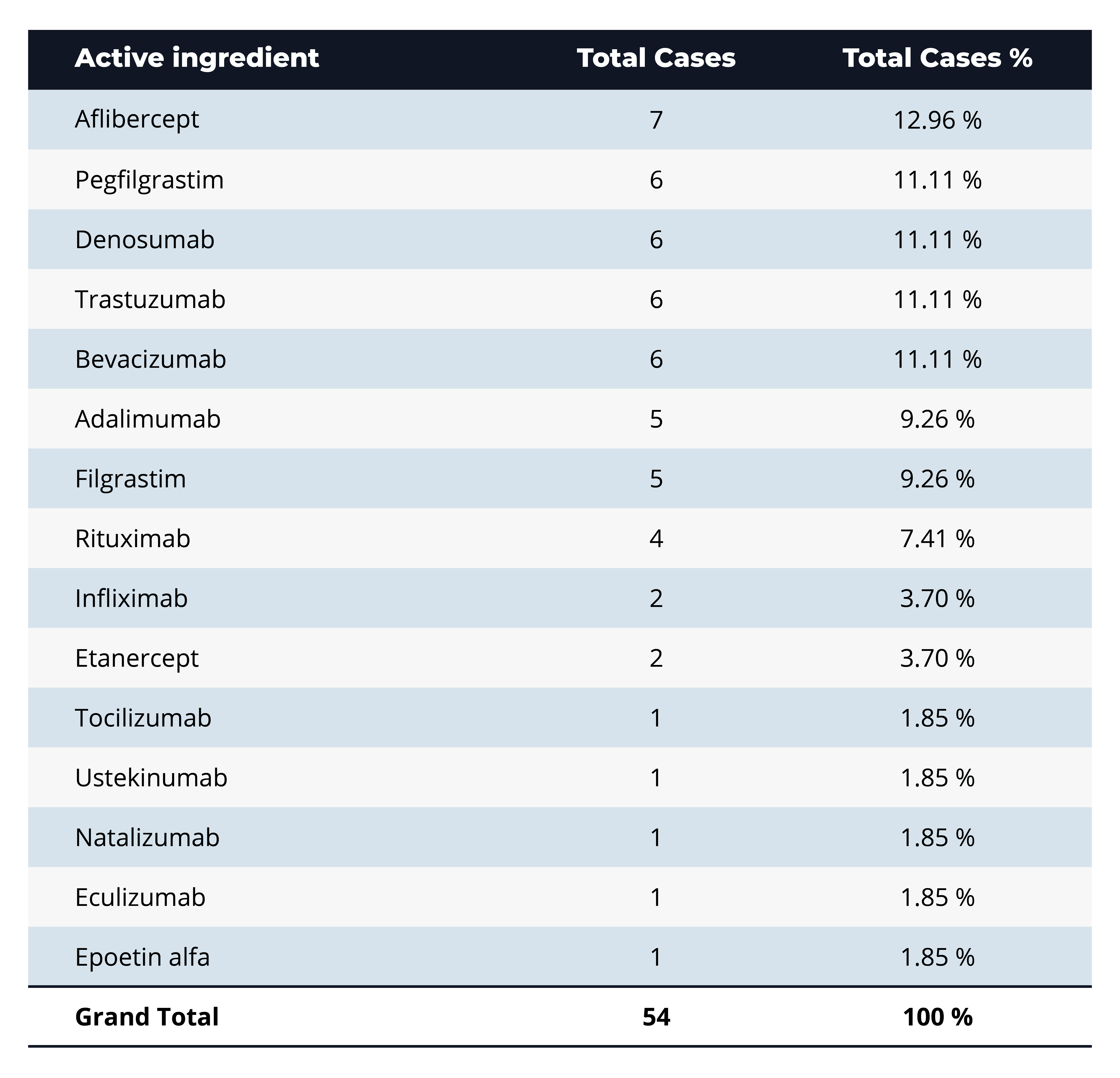

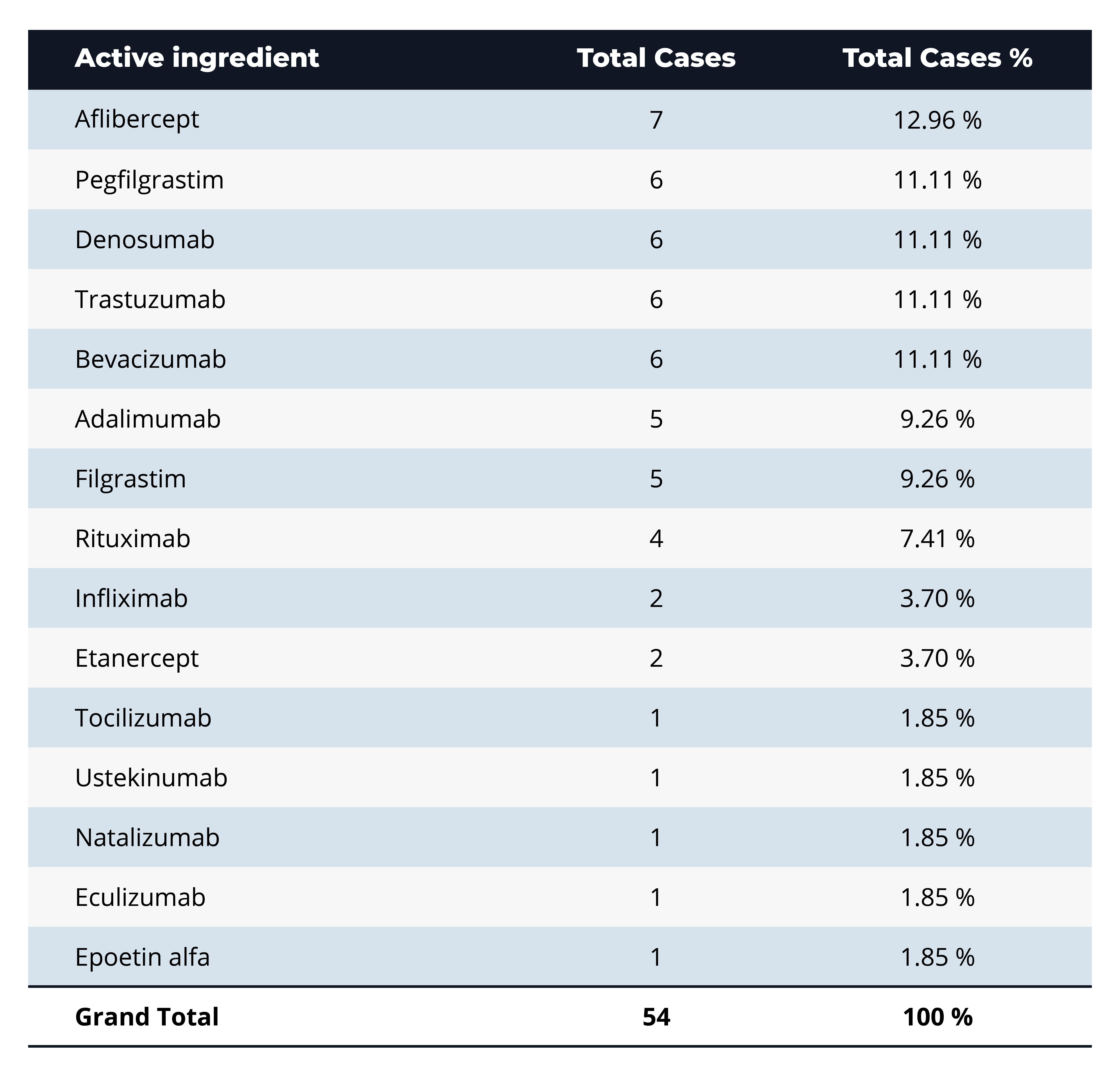

Q: Which active ingredients show up most frequently in BPCIA litigation, and what might that indicate about market competition or therapeutic focus?

A: The most-litigated active ingredient is aflibercept (7 cases, ~13%), with a close runner-up group of pegfilgrastim, denosumab, trastuzumab, and bevacizumab (each 6 cases, ~11%). These top-ranked drugs are all high-revenue biologics in oncology, immunology, and supportive-care indications, highlighting that BPCIA litigation clusters around blockbuster products where biosimilar competition and dense “patent thickets” make market entry most contentious.

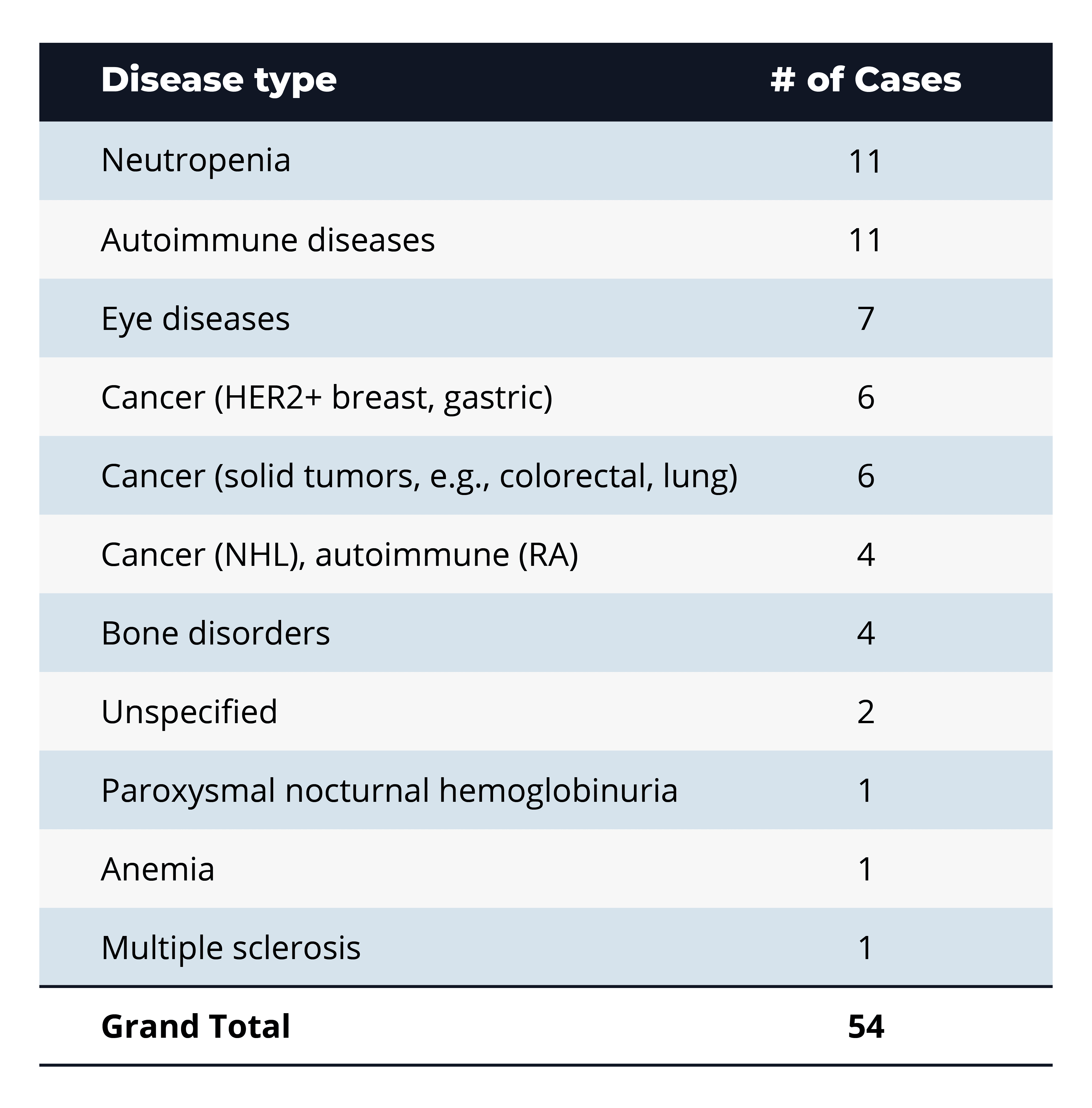

Q: What types of diseases or conditions are most commonly associated with biologics involved in BPCIA litigation?

A: The leading categories are neutropenia and autoimmune diseases (each 11 cases, ~20%), followed by eye diseases (7 cases, ~13%) and various cancer indications (12 cases combined, ~22%). This distribution underscores that BPCIA disputes concentrate on high-value therapeutic areas—supportive-care and immunology agents with large patient populations, as well as oncology drugs where biosimilar entry can significantly impact market share.

A clear “blockbuster bias” drives BPCIA litigation: about 60% of suits center on five high-revenue biologics—aflibercept, pegfilgrastim, denosumab, trastuzumab, and bevacizumab—where multi-billion-dollar sales justify dense patent thickets and aggressive biosimilar challenges. Litigation also tracks clinical demand, with supportive-care agents for neutropenia, autoimmune disorders, and eye diseases accounting for nearly half of all cases, and oncology indications pushing that share above 70%. Conversely, rare-disease biologics (such as PNH and anemia) attract almost no disputes, reflecting their limited market size. In contrast, relatively low counts for newer immunology targets (such as tocilizumab and ustekinumab) suggest a potential surge in litigation as key patents approach expiration.

Q: Which biosimilar products are most frequently litigated in the BPCIA space—and are any facing multiple challenges?

A: MVASI leads the pack of accused biosimilars with three distinct suits, underscoring the high stakes surrounding bevacizumab competition. Other biosimilars—including OPUVIZ (aflibercept), LAPELGA (pegfilgrastim), FKS518 (denosumab), TX05 (trastuzumab), and DRL_RI (rituximab)—each face two separate challenges, illustrating how both originators and biosimilar developers target the most commercially valuable biologics for multiple rounds of patent litigation.

This pattern of repeated disputes reflects the industry’s strategic focus on blockbuster therapies: by challenging multiple patents around a single product, biosimilar sponsors aim to clear a pathway for market entry, while innovator companies fortify their “patent thickets” to protect revenue streams. As these high-value biologics patents head toward their expiration date, we can expect continued—and even intensified—litigation activity around the leading accused biosimilars.

Q: What types of patents are most often asserted in BPCIA cases?

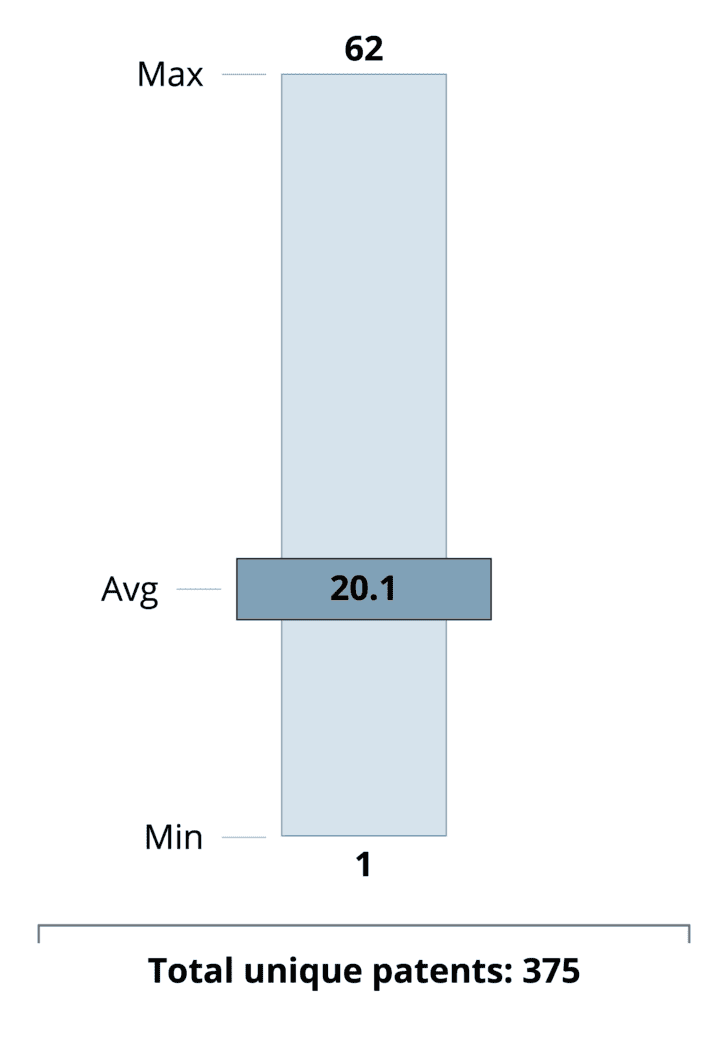

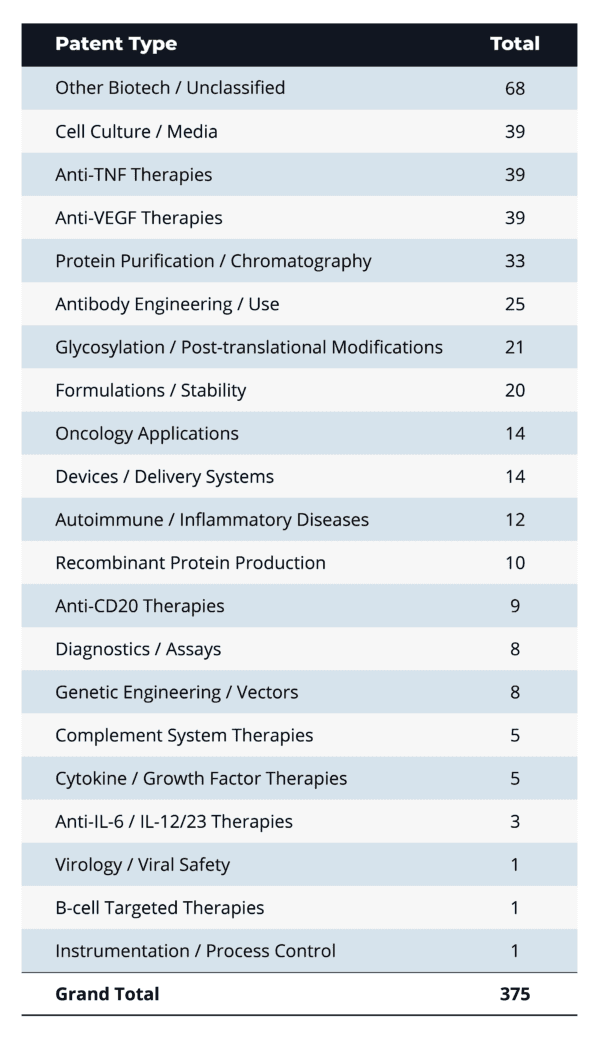

A: On average, BPCIA proceedings involve about 20 patents each (ranging from a single patent to as many as 62), with a total of 375 unique patents asserted across all cases. The most frequently asserted patent types cluster around broad biotech and process technologies: “Other Biotech/Unclassified” leads with 68 patents, followed by manufacturing-related categories—Cell Culture/Media (39) and Protein Purification/Chromatography (33)—and core therapeutic mechanisms like Anti-TNF and Anti-VEGF therapies (39 each).

This mix highlights originators’ dual strategy of protecting both product composition and production methods: upstream process patents guard against biosimilar replication of cell lines or purification steps, while downstream formulation, stability, and delivery patents (Formulations/Stability: 20; Devices/Delivery Systems: 14) secure the finished drug. At the same time, antibody engineering (25), glycosylation/post-translational modification (21), and recombinant production (10) patents underscore the complexity of biologic innovation—and suggest that challenges to manufacturing IP will remain a central battleground as biosimilar entrants seek to navigate these layered protections.