Today, so much of our lives can take place in the digital realm; our finances are fully online, telemedicine appointments have replaced traditional doctor’s offices, and the number of people working from home has never been higher. But now, a new race in cyberspace has begun dominating digital conversations as tech giants and start-ups alike are competing for market share in the metaverse through one thing: virtual reality.

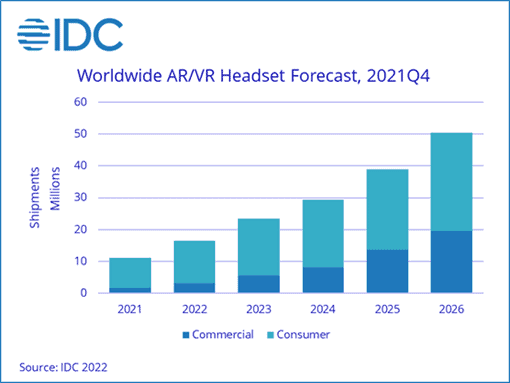

With virtual reality (VR) devices expected to reach a volume of 112.62 million units shipped by 2026, virtual reality technology has carved a significant and growing space in the gaming industry. This equates to a global market size of $84.09 billion by 2028, illustrating a CAGR of 44.8%. Augmented reality (AR) technology is seeing a similar rise as this sector of the market is projected to reach $88.4 billion by 2026. These increases are largely being driven by innovations in 5G and interactive gaming, and are further being propelled by growing investments in immersive technologies after the pandemic pushed everything online.

The global VR and AR market is projected to balloon in value from $14.84 billion in 2020 to $454.73 billion by the end of this decade, with Allied Market Research reporting a possible CAGR of 40.7%. And with this type of rapid growth comes great opportunity as VR and AR technologies are seeing increased implementation across automotive, manufacturing, education, healthcare, entertainment, and corporate industries.

Within the next ten years, we anticipate that virtual reality won’t just be associated with gaming- VR and AR will shift to be an integral part of all major industry operations.

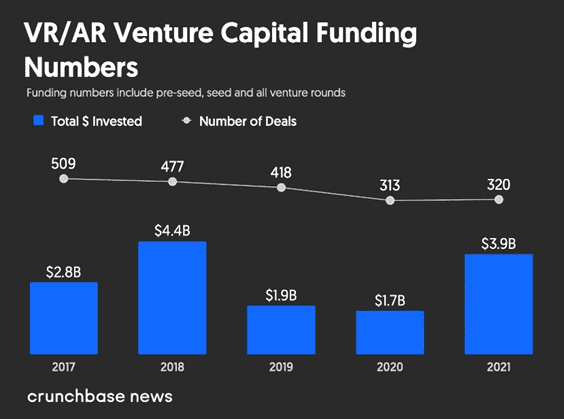

As Crunchbase reported, investments in AR and VR technology are on the rise as 2021’s fourth quarter was unlike any other in terms of venture interest. Close to $2 billion of venture capital was injected into startups in the AR/ VR software and hardware space at the end of last year, making this investment the largest in any quarter ever.

The rebranding and repositioning of the company formally known as Facebook might not have impacted funding directly, but it could have something to do with this influx of VR interest. With Zuckerberg’s increased enthusiasm for making the metaverse his own, he has spearheaded the VR conversation with innovations in wearable tech, upgrades to Horizon Worlds, Project Cambria, and more. In fact, the company expects to spend at least $10 billion this year on research and development into VR, AR, and metaverse-related technologies.

Meta is currently leading the pack in headset revenue as IDC reported that its Quest 2 accounted for 78% of all VR headset sales in 2021. Followed by Meta are DPVR with 5.1% global market share, Bytedance with 4.5%, and VR pioneer HTC coming in the fourth-place spot. But other major companies are beginning to invest in the hardware and software powering VR and AR technologies, and Wall Street sees this increased interest creating a $1 trillion market.

Tech players like Sony, Samsung, Google (think Google Glass or their upcoming AR glasses), and Microsoft (now merged with Niantic, maker of AR-based Pokémon Go) have already debuted VR/AR technologies and are slated to continue innovating in the space, while others like Apple are teasing out plans to release AR glasses and related iPhone capabilities in the near term.

As investors continue flooding the market, smaller startups are going to start shaking up cyberspace, especially in broader use cases unrelated to gaming. New entrants are aiming to create value for consumers, with many of them foregoing the metaverse altogether; AppliedVR has created a workable VR-related business model that can operate without immersive worlds. ManageXR helps companies manage their VR and AR devices using their system, and their company has grown from a mere 30 clients to more than 100 in just ten months as businesses are increasingly looking into implementing VR technologies in their day-to-day.

While these companies are all busy building the next *big thing* in virtual reality, one thing is for certain: no matter the use, the market for these technologies will be propelled forward by innovations in the systems behind their operation. In other words…

Innovations in virtual and augmented reality components will stimulate market competition.

Widespread implementation and deployment of these technologies require advancements in hardware, software, and processing along with improvements to the overall physical design of wearable VR. Many of the issues Meta is facing with VR headset creation is that, to put it simply, the designs are too clunky and heavy to send to market. Additionally, the creation of wireless options is crucial in our increasingly cable-free world; this is more difficult than simply adding a rechargeable battery as the life of that battery is typically limited, and the graphics come through at a lower resolution. This points to the need for graphics card advancements that can not only support these wireless designs but can also make the VR experience so similar to human sight that the user has no distinction between the virtual and physical world.

Additionally, with the introduction of 5G, data processing in VR settings will see reduced lag, lower data congestion, higher-quality displays, and improved mobility. The quest for manufacturers now, though, is to make the necessary advancements in the software behind VR that can support the improved connectivity brought by 5G, 6G, and beyond.

Improvements in overall design, movement tracking, and immersive imaging will push the VR platforms of today to be more like the fully connected devices of the future. And as computer processing power continues to grow and wireless connectivity expands, the capabilities of these machines will continue to widen. But so will the conflicts associated with them.

Industry innovation creates opportunities for complex litigation.

With competition in the industry heating up, many players will be battling over becoming the best system. This friction drives both innovation and opportunities for litigation, particularly in matters regarding antitrust, patent infringement, theft of trade secrets, breach of contract, M&A, and shareholder disputes.

As the virtual reality and augmented reality markets continue to grow (both in and out of the metaverse), advancements in software and hardware paired with the need for regulation in the space will create disputes. We see battles over intellectual property to be some of the most prevalent as developers will have to start fiercely defending their IP when the market becomes more saturated. Further, major acquisitions happening in the VR market will prompt M&A and theft of trade secret cases. We also project debates over data retention and processing, especially if industry regulations surrounding consumer data protections come later rather than sooner.

If your company needs help preparing for these challenges, reach out to WIT for the best experts who can advise you on your strategy. Our expert teams were created to address what we expect to be the key areas of litigation in emerging video gaming content and technologies.