At the start of the millennium, consumer adoption of smartphones had barely begun, 2.5G dominated industry conversations, and IoT executives were still trying to understand how exactly these new generations of connectivity would continue to manifest in the market. By 2003, the second digital wave swept the industry, bringing the number of connected devices up to 500 million. Today, amid the third digital wave, a whopping 29 billion devices are connected because of one world-changing technology: 5G.

The emergence of the wireless industry’s fifth-generation spectrum has disrupted operations across a myriad of sectors, prompting innovation and enabling further integration of the IoT into all facets of our daily lives. The global 5G market is projected to expand at a CAGR of approximately 14% YOY until 2025 on account of the demand for worldwide wireless broadband services. Additionally, over the next 15 years, this new spectrum is poised to generate more than $2 trillion in support of the global economy. This continued growth is igniting innovation and creating opportunities for smarter cars, smarter cities, and smarter homes.

Within the next ten years, we anticipate that interconnected devices will become the industry standard and that 5G technology will push forward the evolution of communication, business operations, and social standards.

This year, 5G networks are being deployed or funded across every continent worldwide. According to the Global Mobile Suppliers Association, 493 operators in 150 countries and territories were investing in 5G regarding trials, acquisition of licenses, planning, network deployment, and launches. Of that group, 214 operators in 85 countries and territories have launched 5G mobile services.

Consequently, the number of consumers adopting this technology is soaring; the number of 5G users is expected to exceed 1 billion by the end of 2022 after just 3.5 years in operation, illustrating the industry’s quickening growth as the same level of expansion took four years for 4G and 12 years for 3G.

The west is at the forefront of 5G network launches with the Americas seeing the most widespread connectivity overall. In addition, according to Viavi Solutions, the United States and China are currently the countries with the most 5G cities at 356 and 296, respectively. However, in terms of overall 5G integration across regions, the Europe, Middle East, and Africa (EMEA) region leads the race with 839 active city networks as compared to the Asia Pacific (APAC) region with 689 5G cities, and the Americas with 416.

With this growth comes increased revenue that is in turn fueled by a consistent stream of investment dollars, creating a spat for the biggest slice of the spectrum. In other words,

Investments in the 5G spectrum will stimulate market competition.

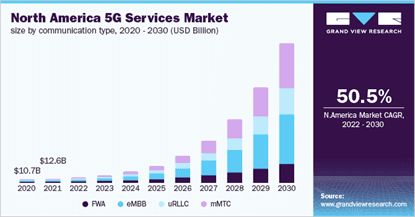

At the end of 2021, the global 5G services market was valued at close to $50 billion. The United States market alone accounted for one-quarter of that value at $12.6 billion and is expected to grow at a CAGR of 50.5%. This value continues to increase as more and more providers pour investment dollars into the deployment of the spectrum. In fact, the nation’s big four wireless carriers have been doing just that; over the past two years, AT&T Inc., Verizon Communications Inc., T-Mobile US Inc., and DISH Network Corp. have spent close to $100 billion to acquire mid-band spectrum. And this year, investments have continued to expand.

At the start of 2022, Fierce Wireless reported that Verizon pledged to cover 175 million people with 5G technology by the end of the year, spending upwards of $22.5 billion to launch the technology. The company’s CFO claimed that 2022 is a “peak investment year” with a focus placed on C-band 5G deployment across the US. AT&T plans to spend close to $24 billion in an attempt to cover 70 million Americans in the same timeframe with the company’s CFO predicting investment figures for 2023 and 2024 to be similar.

Dish Network plans to spend $2.5 billion on its greenfield nationwide 5G network to continue covering consumers in the US, building upon its already established broadband service network currently available to 20% of the nation’s population. T-Mobile, which boasts the strongest 5G coverage of the four, aims to invest close to $13 billion to provide over 260 million consumers with 2.5 GHz 5G by the end of the year, rising from 201 million in 2021.

While various telecom service providers around the globe are attempting to fund 5G infrastructure, many are placing a strategic focus on mergers and acquisitions to increase their market share. Ericsson and T-Mobile are now collaborating to usher in a series of high-speed 5G solutions, and in June, Qualcomm acquired Cellwize Chime, an Israeli-based mobile network management and automation platform, to help simplify and amplify 5G network expansion. This ongoing expansion will undoubtedly affect industries in all sectors.

Because of the stark improvement in the spectrum, 5G frequency will enhance the capabilities of all industries from real estate to healthcare to finance. 4G illustrated just how much wireless technology can impact a country’s landscape; with the lower latency and greater functionality brought on by 5G, this new generation will revolutionize the world as we know it.

According to Deloitte, “Nearly nine in ten businesses expect advanced wireless technology, including 5G and the latest WiFi standards, to transform their organizations and their industries within three years.”

Though they already dominate headlines today, more sophisticated artificial intelligence, augmented reality, and virtual reality experiences will begin to hit the mainstream en masse when 5G is fully deployed. The automotive market will also be completely transformed with the introduction of autonomous vehicles; according to the CTIA, wireless-connected self-driving cars could save 21,700 lives and save $447 billion annually. Further, connected devices will save $305 per year in healthcare costs, and connected applications will generate $700 billion in retail sector growth. And 5G will have a $650 billion impact on manufacturing through the end of the decade. While all of these industries and more will reap extensive benefits from 5G, the spectrum’s widespread reach will also cause a wide range of legal disputes.

Industry innovation creates opportunities for complex litigation.

Improved connectivity creates opportunities and challenges for companies looking to defend or expand their stake in the market. To that end, we see opportunities for disputes regarding antitrust, patent infringement, theft of trade secrets, breach of contract, and M&As.

As we know, the industry is currently rife with mergers and acquisitions with many industry players looking to dominate as much of the spectrum as possible. We see this inciting major litigation and further prompting disputes regarding theft of trade secrets and antitrust implications. Further, intellectual property conflicts will dominate the legal landscape as licensing issues and patent infringement suits have already been at the forefront of the industry.

If your company needs help preparing for these challenges, reach out to WIT for the best experts who can advise you on your strategy. Our expert teams were created to address what we expect to be the key areas of litigation in emerging video gaming content and technologies.