The evolution of cryptocurrency has been wildly tumultuous, and the industry remains in flux as regulators finally attempt to reign in these unpredictable digital assets. After the Securities and Exchange Commission sued Coinbase at the beginning of June, the United States’ largest crypto exchange has pushed back, claiming that the SEC lacks the authority to govern the assets on their platform as they are technically not defined as securities. Further, the SEC also filed a separate suit against Binance, the world’s biggest cryptocurrency exchange, and Bittrex, a now-bankrupt crypto giant, making similar claims about the companies’ operations and the categorization of their tokens.

As these crypto exchanges continue to feud with federal regulators, many in the industry are wondering: how will the market shift if the SEC wins their suits? And further, what will the legal implications be in the instance that these digital assets are considered securities? Let’s take a quick look at the conflict and see where future legal complications may lie.

Securities or Not? Fighting to Define Fintech’s Most Divisive Assets

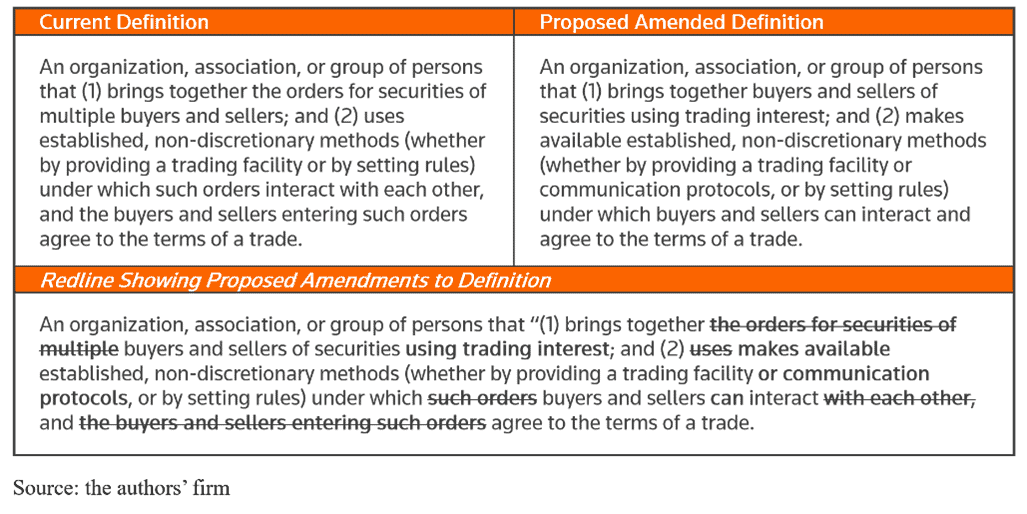

After Coinbase filed a suit at the end of April requesting that the SEC finally responds to their July 2022 petition, the regulator began filing its own suits claiming that Coinbase, along with Binance and Bittrex, failed to register as a national securities exchange, broker-dealer, and clearing agency. They are also attempting to redefine what makes a security, broadening the scope of what constitutes an exchange as shown below. If the new definition is adopted, they could expand their regulatory action to encompass more crypto companies.

Source: Reuters

In response, Coinbase, Bittrex, and Binance have all filed petitions against the suits, arguing that the SEC has been flippantly attempting to regulate the tokens based on pre-digital age legislature. These old statutes do not directly govern these newer digital assets, and to apply them, Bittrex feels that they must get Congressional approval because “‘sometimes old statutes may be written in ways that apply to new and previously unanticipated situations […] But an agency’s attempt to deploy an old statute focused on one problem to solve a new and different problem may also be a warning sign that it is acting without clear congressional authority,”. Coinbase also refuted their claims by explaining that the tokens they host are not investment contracts and therefore, not securities.

The Legal Implications

With crypto disputes becoming more complex by the day, it is important to understand the implications associated with these enforcement actions. Those who oppose the SEC’s approach feel as if their suits pose an existential threat to the cryptocurrency market, and these suits will directly establish how (and if) cryptocurrencies operate and are regulated in the US. And if, at some point, these digital tokens are considered to be securities, crypto companies will have to register with the SEC as an exchange or register as a broker-dealer and comply with Regulation ATS.

As we move further into this hostile regulatory landscape, WIT expects a wave of legal action to ensue, regardless of the outcomes of the current disputes. Continued complications with regulatory bodies are undoubtedly on the horizon, especially if the tokens do qualify as an exchange as failure to register allows the SEC to bring civil action against the company in question.

It is crucial to engage with knowledgeable experts to prepare for a potential industry shift. Specifically, consulting with cryptocurrency experts who are uniquely positioned to assist counsel and their clients in active litigation matters, and in assessing and avoiding the potential liabilities that might arise as the regulatory landscape in the crypto industry continues to evolve is essential. For example, former Wall Street executives, traders, technologists, academics, and crypto experts that specialize in cases involving complex financial products, currency exchanges, crypto assets, trading platforms, and industry-specific M&A and accounting issues can assist counsel in:

- Determining if, in fact, securities are traded on a client’s specific platform

- Helping cryptocurrency purveyors determine the right way to restructure their business in light of regulatory decisions

- Explaining new or evolving regulations regarding crypto exchanges and how they apply to each platform’s operations

- Creating a comprehensive risk management program to identify and control a company’s risks in both its financials and operations through planning, testing, and framework implementation

- Understanding how to properly register as an exchange or broker-dealer to avoid violating securities law

Need help navigating the evolving cryptocurrency market and staying up to date on crypto news? WIT has teams of fintech experts prepared to address incoming disputes in the space. Our expert teams were created to address what we expect to be the key areas of litigation in emerging financial technologies, digital assets, and cryptocurrencies and exchanges.