Since the start of the United States’ electric vehicle revolution, one of the biggest points of contention has been consumers’ inability to access reliable, compatible charging stations throughout the country. Time and time again, EV industry critics have claimed that range anxiety and lack of proper charging infrastructure were massive barriers to widespread EV adoption, pushing automakers and lawmakers alike to find a plausible solution to this growth-hindering problem. After the Department of Transportation announced new EV charging standards early this year, Tesla was pushed to offer its North American Charging Standard (NACS) technology to other electric vehicle manufacturers to continue receiving federal funding for the expansion of their stations. This effort has already begun, and the EV giant has until the end of 2024 to ramp up domestic manufacturing to produce or retrofit at least 7,500 chargers that are compatible with all EVs.

Now, those in the EV industry are moving to adopt NACS technology with the hopes that greater access to reliable chargers will increase consumers’ interest in purchasing an electric vehicle. But what are the legal risks associated with switching the standard?

The EV Charging Infrastructure Evolution

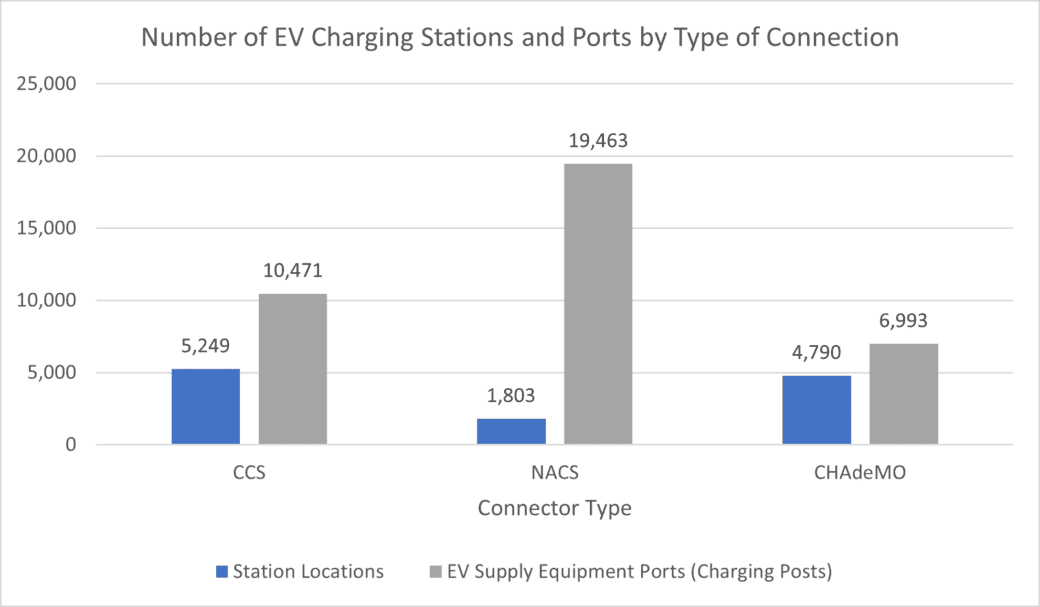

While North America’s Combined Charging System (CCS) currently has a larger footprint than Tesla’s NACS (5,240 CCS stations vs 1803 Tesla Superchargers), Tesla has more ports (charging connectors) than CCS and CHAdeMO (another of the industry’s most prominent rapid charging standards) combined. Further, it has been reported that Tesla’s chargers are easier and more convenient to use than other DC fast chargers from brands like ChargePoint.

Source: US DOE Alternative Fuels Data Center

Since Tesla announced that they would be opening their network of NACS Superchargers to the market, major automakers including Ford, GM, Mercedes- Benz, Rivian, and more have reported that their vehicles will be compatible with the EV maker’s charging network starting in 2024. To start the switch, these companies will offer adapters allowing drivers to access the NACS network before eventually building NACS ports right into their newly manufactured EVs. Further, Electrify America, which is the US’s largest, non-Tesla fast charging network, and ChargePoint have committed to adding NACS chargers to their stations in the future.

The adapters aren’t the only updates automakers will have to implement when switching to NACS; they will also have to create new software that allows their vehicles to work with Tesla’s Supercharger software. But all these updates could create a myriad of problems regarding interoperability, system communications, and supply chain capabilities. To comply with these growing NACS requirements, CCS and NACS will have to be able to efficiently communicate with one another. And, to add NACS capabilities to charging stations, charging companies will need a strong supply chain that can quickly produce cables and connectors that comply with industry standards.

Potential Legal Implications

Despite many major automakers moving to adopt NACS, it is not yet considered to be the industry’s standard (though that may change in the future). The Charging Interface Initiative (CharIN) association, which is the organization behind CCS and MCS charging systems, feels that NACS must go through due process via a standards development organization. And recently, that request was answered; SAE International announced at the end of June that they would be looking to standardize NACS connectors at an expeditated rate (in six months or less) as it is seen as one of the key initiatives to grow North American charging infrastructure.

As we know, having a proper standard in any industry is very important, and the EV space is no exception. Setting open charging standards will allow those in the industry to become suppliers or users of this technology, which could ignite a slew of conflicts over anti-competition laws, patent disputes, and more. Antitrust disputes may arise as those automakers who choose to NOT adopt NACS may feel that Tesla has an unfair monopoly over the charging market, alienating their consumers. Further, making NACS the industry standard could ignite disputes with drivers as CCS chargers may begin being phased out despite most of the EVs on the road today requiring CCS capabilities, making their systems essentially inoperable (similar to the phasing out of 3G in connected vehicles).

It is also important to note that while Elon Musk was pushed to offer his charging network to other automakers by the government, he also has personal incentives for standardizing this technology: data collection. Tesla’s NACS chargers feature two small data ports that can collect a hoard of information about the car and its users. This could directly impact market competition; if Tesla can siphon off data from rival vehicles, they could utilize that data to inform their operations, in addition to selling it off to other market players, and create legal risks in the realm of cybersecurity, data privacy, and more. Even if Tesla’s systems are operating on a secure network, other brands may possess vulnerabilities in software that open them up to data privacy concerns.

Finally, while this switch seems like a no-brainer to some companies, others are not as receptive to the move- at least without a proper plan in place. Lawmakers in Texas have planned to mandate EV charging companies to include the NACS if they want to utilize federal funds in expanding charging infrastructure. But the charging firms pushed back, saying that it is too premature and “risks the successful deployment” of federal fund rollouts. Texas could set a precedent for the remainder of the country’s state transport departments as California, Michigan, Iowa, and Washington are considering similar decisions. And while some charging companies are supporting the switch, others may take legal action if states continue to push the system before it is officially standardized. The group has already stated that they will be contacting the federal government regarding the issue, which could fuel even more regulatory action.

While this switch to NACS technology won’t happen overnight, it is important to consider the types of experts that can prepare clients for likely changes in the standard to ensure that companies comply with new industry requirements. These experts can also help clients navigate this rapidly evolving environment and support them in potential future disputes involving charging technology.

An electric vehicle charging expert team could include:

- Industry insiders on the EV landscape, EV adoption, and related regulations and standards

- Battery technology experts on battery design, production, and the sourcing of materials

- Mechanical engineers on electric vehicle components and manufacturing

- Power management specialists on control systems, engine design, and charging infrastructure

- Wireless technology engineers on EV software, wireless networks, and connectivity issues

If your company needs help preparing for challenges surrounding improvements in electric vehicle charging infrastructure, reach out to WIT for the best experts who can advise you on your strategy. Our electric vehicles expert team was created to address what we expect to be the key areas of litigation in the move to electric fleets.