Cryptocurrency crashes, stock failures, and banking collapses have dominated many headlines over the past year. While stocks and digital assets have somewhat stabilized amid volatile market conditions, the banking industry is still weathering troubled waters as M&A suits, regulatory investigations, and more are making waves in the space. The last time the United States economy experienced this much volatility was during the 2008 Financial Crisis, and the market conditions that ignited that recession offer insights into what may come in the banking crisis’ wake.

But just how similar are the conditions between the current banking crisis and the ‘08 collapses? And what do the similarities around these financial crises allow us to infer about the impact of litigation risk? Let’s take a quick look at the state of the banking crisis, how it compares to the ‘08 crash, and see where litigation may lie if economic conditions continue to worsen.

A Quick Look at the Current State of the Banking Crisis

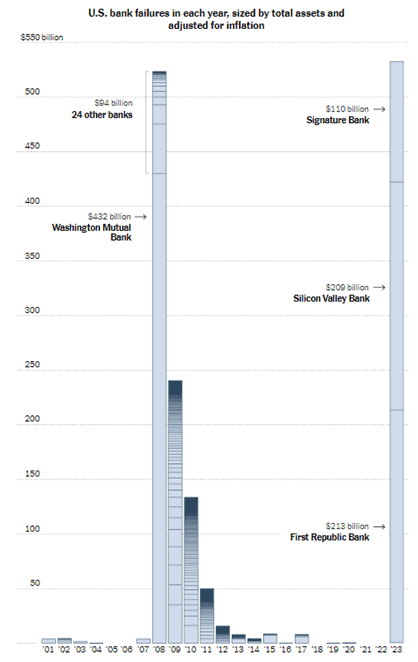

Now three months into an industry-wide crisis, the banking sector seems to have momentarily contained collapses among major institutions. But that doesn’t mean that the financial industry is out of the woods; despite the Federal Government’s attempts to bail out the industry and claim that the volatility is largely resolved, many analysts agree that trouble in the banking space is far from over. What started with the collapse of Silicon Valley Bank and Signature Bank, which now represent the second and third-largest bank failures in US history, has now spurred FDIC, DOJ, and SEC investigations, acquisitions, increased regulatory oversight, and more. As of June 12, UBS has officially taken over major rival Credit Suisse, and JP Morgan purchased the failing First Republic Bank, officially overtaking the 2008 crisis in terms of failure asset value.

Source: NYT and the FDIC

Extreme stress on the industry is being exacerbated by rising interest rates and commercial real estate complications. The Fed failed to react to inflation promptly, causing interest rates to surge earlier this year. While new reports now show that inflation levels show signs of cooling, the precariousness of the banking industry is still in jeopardy of losing billions in profits on low-wielding assets. In addition, high funding costs and an ailing commercial real estate market now pose major risks for midsized banks; small banks account for nearly 70% of outstanding real estate loans, and when paired with the deposit volatility spurred by investor anxiety, these institutions will be feeling unprecedented pressure if economic conditions deteriorate further.

Currently, the contrasting opinions of those in the industry are painting a fuzzy picture of what’s to come in this crisis, but as it continues to play out, more and more forecasters are starting to notice the parallels between the ‘08 crisis and today’s conditions, using the similarities to warn against an impending recession.

Back to the Future: Similarities to the 2008 Financial Crisis

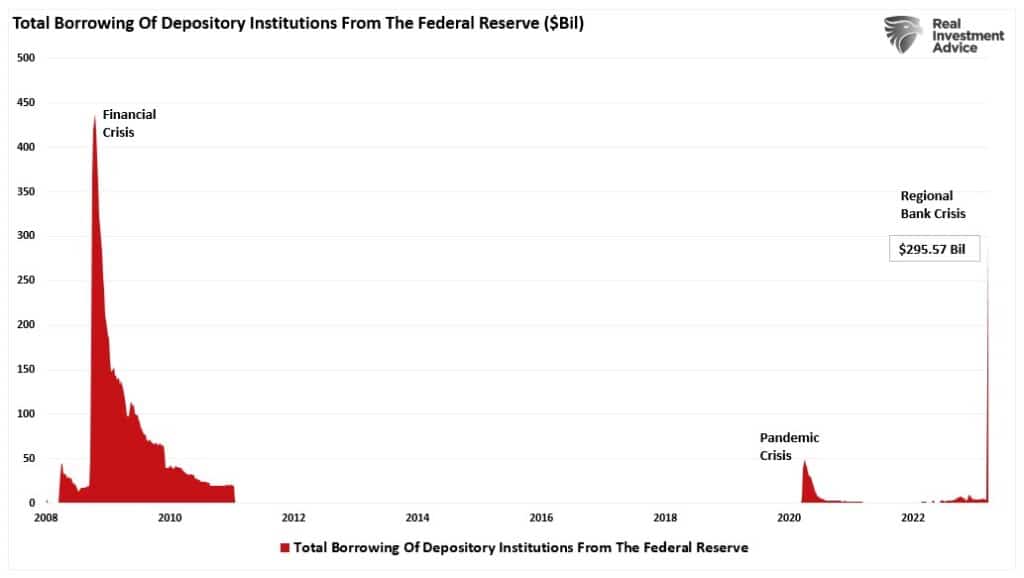

Even though these two financial crises were not spurred by the same issues, the way that the industry reacted because of the turmoil is proving to be surprisingly similar. ‘08’s collapse was driven by subprime mortgages as home prices began declining in 2006. The Fed had been raising interest rates for almost two years by then to ward off inflation, similar to today’s market conditions. But increases in interest brought increases in defaults, and major banks like HSBC, Bear Stearns, and Citigroup began incurring major losses. Despite the industry and government’s shared attempts at stabilizing the market, a bank run similar to that seen in March 2023 occurred and thus began the ’08 recession.

While the Fed has been similarly increasing interest rates since March 2022 to a now 16-year-high, we started to see just how much they were impacting the economy when these previously “unsinkable” banks began taking on water and capsizing. In an attempt to keep the market afloat, banks looked to the Federal Reserve for support, borrowing almost $30 billion— the most in one week since 2008.

JP Morgan CIO Bob Michele warned CNBC that the current market conditions remind him of March- June in 2008. The banks that were unable to be saved by the Federal Reserve have since been taken over; JP Morgan acquired First Republic Bank after its failure just as it did with Bear Stearns fifteen years ago. And despite the stock market’s ongoing rally following the initial turmoil of the banking crisis, experts have warned that these conditions are reminiscent of those seen leading up to the 2008 financial crisis. Further, the bond-yield curve, which is the industry’s most trusted recession indicator, has now been inverted for its longest streak since the 1980s. Since the curve has predicted all but one recession, many feel that is flashing a warning light on an impending catastrophe.

How Would a Recession Impact Litigation?

Amid the current crisis, we have already seen multiple disputes hit the courts over fraud, M&As, bankruptcy, and more. But this is only a taste of what’s to come if the economy officially enters a recession similar to the one experienced in 2008. That financial collapse had a significant impact on litigation and in the instance of a recession on account of banking volatility, the legal landscape could be impacted in multiple ways:

- Increase in Litigation: The financial crisis in 2008 resulted in a significant increase in litigation, particularly in the areas of securities fraud, mortgage-backed securities, and other complex financial instruments. Many investors and financial institutions suffered significant losses, and they turned to the courts to seek compensation. We are already seeing similar suits occur on account of banking volatility, and in the case of a complete collapse, there will undoubtedly be an influx of disputes hitting the courts involving shareholders, government investigations, lost investments, and more.

- Increased Regulatory Enforcement: ‘08’s crisis also led to increased regulatory enforcement, with government agencies such as the SEC and DOJ pursuing cases against financial institutions and individuals. This, in turn, led to more civil litigation, as plaintiffs’ attorneys used the government’s findings as evidence in their cases. Once again, multiple SEC and DOJ investigations spurred from the first wave of bank crashes are already underway, and the Federal Reserve has begun a comprehensive review of bank regulation. New laws could alter banking operations from the ground up, creating more opportunities for disputes.

- Settlements: Many financial institutions chose to settle cases rather than face the uncertainty of a trial after the ‘08 recession. This led to a significant increase in the number and size of settlements, with some financial institutions paying billions of dollars to settle lawsuits that went on for years. In any instance of an institutional collapse, settlements are common and with the amount of disputes that will surface in the wake of the crisis, we will likely see a surge of settlements leaving the courts.

- Bankruptcy Proceedings: 2008’s crisis also resulted in a significant increase in bankruptcy proceedings, particularly in the real estate and construction industries. Bankruptcy courts were overwhelmed with cases, and many bankruptcy judges had to be appointed to handle the increased workload. Since the start of the year, bankruptcies have been on the rise and if the economy continues to worsen, companies will be struggling even harder to stay afloat.

After examining the financial crisis of 2007-2008, it is evident that the recession had a profound impact on litigation, resulting in a significant increase in the number and complexity of cases, as well as regulatory enforcement and bankruptcy proceedings. Those involved in the industry should begin preparing now for the danger associated with an impending recession, and engaging with banking experts can help those in the industry with a risk management strategy to stay ahead of the curve when it comes to potential litigation.

Engaging with Experts to Mitigate Risk

With the legal landscape around the banking crisis actively developing, those in the industry should look for ways to safeguard their operations to stay stable in the instance of a recession.

At WIT, we have built a diverse team of banking experts comprised of leading academics and banking industry insiders with years of consulting and testifying experience in the subjects most relevant to litigation involving banking, financial services, and wealth management. Our banking experts include former bank chief compliance officers, former bank executives, insider trading experts, bank monitors, former regulators, and more who can address issues involving:

- Bank Charters

- Banking Industry Growth and Consolidation

- Banking Industry Policies and Standards

- Banking Apps and Technology

- Banking Operations and Due Diligence

- Cryptocurrencies and Digital Assets

- Digital Banking

- Economic Conditions and Market Environment

- Fiduciary Responsibility

- Management of Capital, Liquidity Strategies, and Counterparty Relationships

- Regulatory and Compliance

- Trading Platforms & Transactions

In addition to helping create a successful litigation strategy, engaging with WIT’s banking experts before conflicts arise can assist you in establishing a strong risk and compliance program, protecting you from future disputes.

Stay a step ahead of the unfolding banking crisis. Reach out to WIT for the best experts to inform your litigation strategy. Our expert teams were specifically built to address the needs of the banking industry and the lawyers that represent it.